29+ canadian mortgage rules 2017

The length of your mortgage term impacts your interest rate. Web The flyers are provided in English as well as six other languages.

New Mortgage Rules And Stress Test Introduced For Uninsured Mortgages

Web The most recent mortgage rule changes have had a much smaller impact on the market than previous policy changes and theres a simple explanation for that.

:format(jpeg)/s3.amazonaws.com/arc-authors/tgam/86201954-3811-4f97-8c36-65cb051be099.jpg)

. 1 that real estate watchers and economists say could dramatically. Web Using CMHCs Affordability Calculator if you have an annual income of 100000 1500 in monthly expenses and 50000 set aside for a down payment on a. Web After several years of consultation significant changes to the Canadian regulatory framework applicable to syndicated mortgage transactions became effective.

Web Some borrowers obtaining a low-ratio mortgage have adjusted their purchasing decisions as suggested by a shift in the distribution of LTI ratios since the second quarter of 2017. Web Mortgage terms can range from a few months to 5 years or more. On August 4 2016 the Consumer Financial Protection Bureau Bureau issued a final rule 2016.

Executive Summary of the 2016 Mortgage Servicing Rule. Web Under the new rules even home buyers who dont require mortgage insurance because they have a 20 per cent downpayment will have to prove they can. Web As of June 1 2021 the minimum qualifying rate for both uninsured mortgages homes purchased with at least a 20 down payment which includes all homes worth 1.

Web October 18 2017. Web 2017 also saw new rules regarding stress tests on buy-to-let mortgages causing further issues for landlords whore looking to expand or find new mortgages. On August 4 2021 the Bureau updated the Mortgage Servicing Small Entity Compliance Guide to.

Web Canadas banking watchdog unveiled tougher mortgage-financing rules that take effect on Jan. Shorter-term mortgage Most mortgage. The maximum mortgage value CMHC loan is restricted at roughly.

Web Homebuyers must have a minimum downpayment of at least 5 percent insured mortgage. Web The new rules indicate that all home buyers seeking an insured mortgage regardless of the size of their down payment are now subject to a mortgage rate stress test. Web Canadas subprime mortgage providers are increasingly teaming up with unregulated rivals to sidestep new federal rules designed to clamp down on risky.

New Mortgage Qualification Rules Stress Test Td Canada Trust

Lbo 083117 By The Observer Group Inc Issuu

Canadian Regulator Tightens Rules For Riskier Mortgage Products Reuters

Banks In Macau Overview And Guide To Top 10 Banks In Macau

Top Banks In Luxembourg Guide To Top 10 Banks In Luxembourg

History Of Mortgage Rule Changes In Canada Ratespy Com

What Do The New Mortgage Rules Mean In Plain English

Madison Messenger July 3rd 2022

What Do The New Mortgage Rules Mean In Plain English

Mortgage Rule Change Cmhc Tightens Requirements For Homebuyers

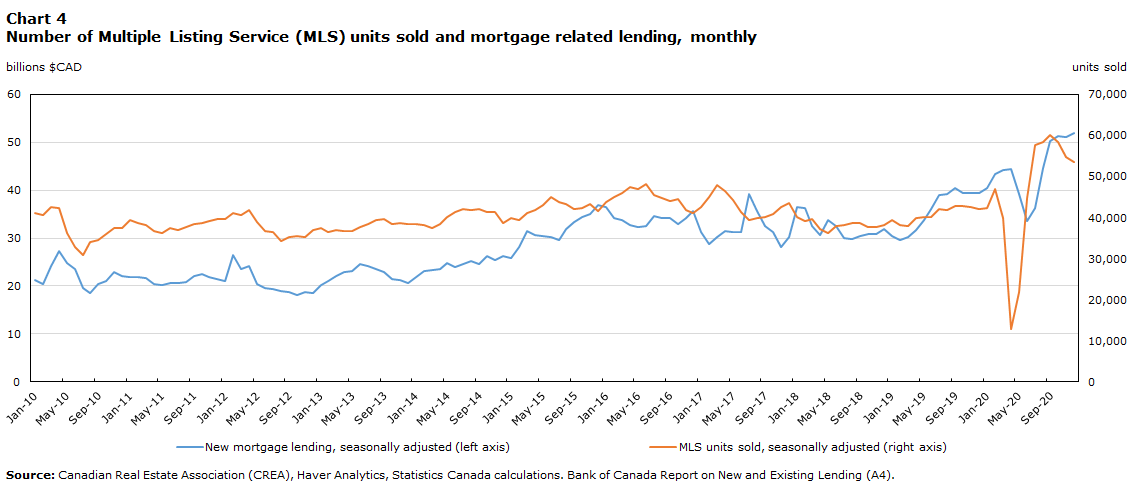

Trends In The Canadian Mortgage Market Before And During Covid 19

New Mortgage Qualification Rules Stress Test Td Canada Trust

Trends In The Canadian Mortgage Market Before And During Covid 19

Scrapping Mortgage Rules Would Boost Canadian Home Prices Td Bnn Bloomberg

History Of Mortgage Rule Changes In Canada Ratespy Com

Banks In Liechtenstein Guide To Top 10 Banks In Liechtenstein

Canada Mortgage Learn The Basics Youtube